NCBA Bank has been embroiled in various reports of unethical practices, which continue to tarnish its reputation.

The latest accusations surrounding the bank’s hiring and promotion processes suggest that ethnicity may be prioritized over qualifications and merit.

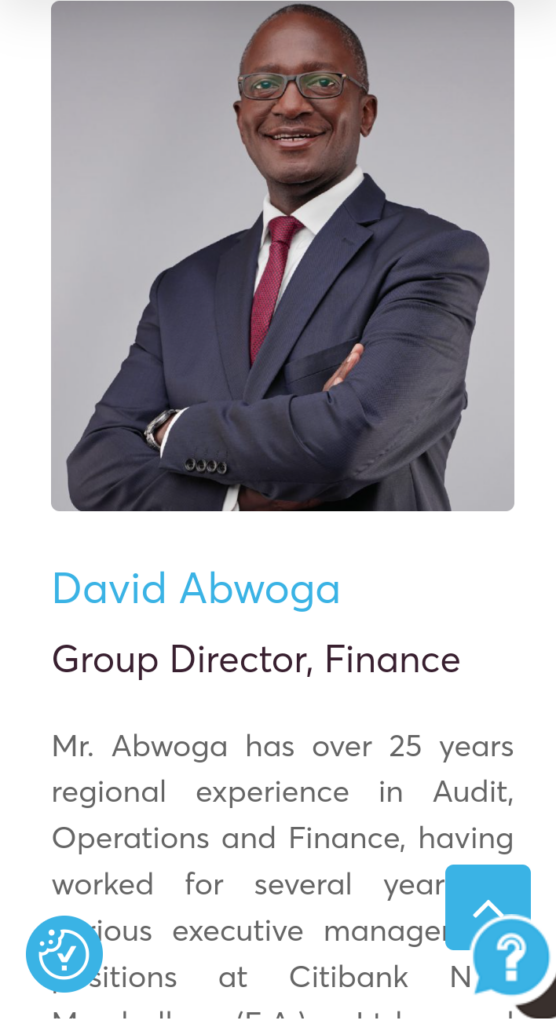

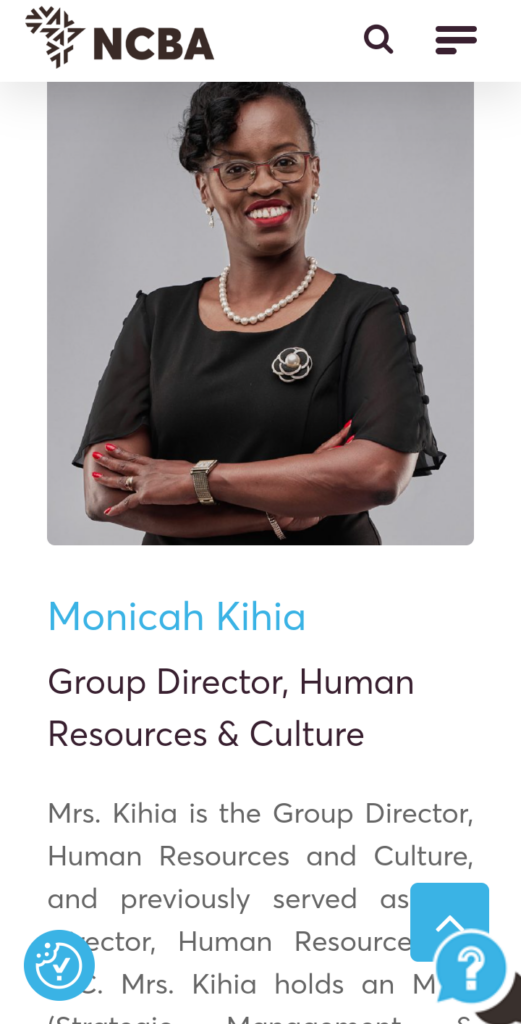

Notably, 95% of the bank’s senior positions are reserved for the Kikuyu ethnic tribe, where the bank’s CEO Mr. John Gachora hails from.

This unorthodox practices raise questions about fairness, integrity and the institution’s purported claim of upholding diversity, fairness and inclusion.

In previous years, NCBA Bank has faced public pressure for alleged misconduct, including its controversial role in the banking sector.

Critics have pointed to instances of questionable loan approvals and concerns over compliance with financial regulations.

Such scandals have painted a picture of a bank that struggles with governance issues, further exacerbating public mistrust.

Adding the recent allegations of ethnic bias only deepens the concerns surrounding the institution’s operational integrity.

The accusations of favoritism in hiring and promotion suggest that the Kikuyu ethnic group dominates leadership roles, potentially sidelining highly qualified individuals from other communities.

Employees and job seekers have anonymously raised these concerns on online forums, complaining about a lack of transparency in recruitment and internal promotions which are twisted to ensure that only the Kikuyu tribe can prosper in the bank.

These allegations contradict the bank’s publicized values of equity and professionalism, as outlined on its official platforms.

NCBA has consistently portrayed itself as a champion of equal opportunity, yet such claims expose a significant gap between rhetoric and practice.

This pattern of behavior is not new for NCBA, which has been previously criticized for opaque practices in its banking operations.

Reports of irregularities in loan structuring, failure to adhere to anti-money laundering guidelines, and complaints from customers about hidden charges have all contributed to an image of an institution that struggles with ethical accountability.

These past scandals, combined with the current allegations, reveal a systemic issue that requires urgent attention.

Ethnic favoritism, damages workplace morale, fosters resentment, and undermines employee productivity.

It also tarnishes the bank’s public image, potentially driving away clients who value fairness and professionalism.

Regulators may need to intervene to ensure that NCBA adheres to labor laws and addresses these claims since as it claims, it is a national bank reaching out beyond Kenya’s borders and not a Kikuyu bank.

NCBA Bank must take immediate steps to address these concerns by conducting independent audits of its hiring practices, implementing transparent systems, and publicly committing to diversity and inclusion.

Without concrete action, these allegations will continue to harm its reputation and undermine its claims of being a responsible and trustworthy financial institution.