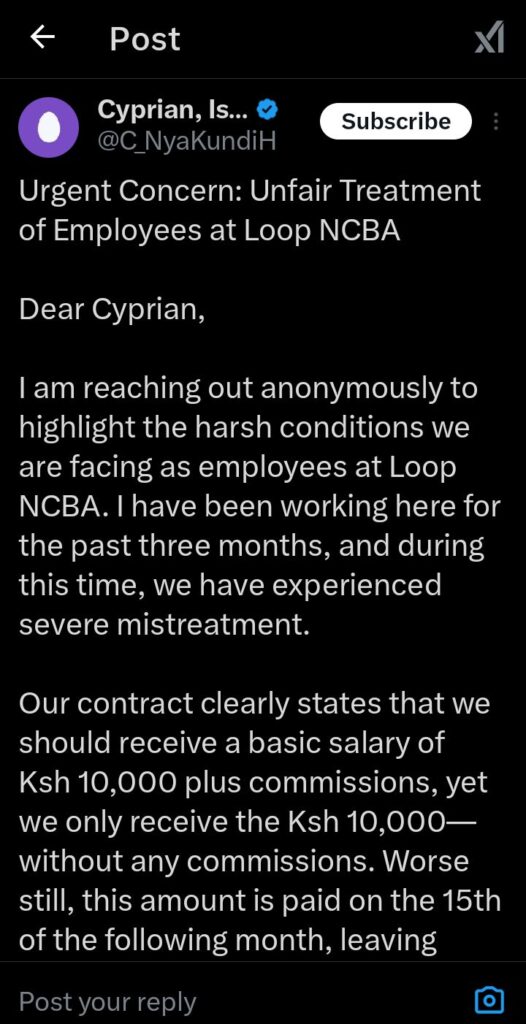

Cyprian Nyakundi has once again exposed shocking details of corporate exploitation, this time involving NCBA Bank’s digital banking service, Loop NCBA. A whistleblower has revealed how employees are suffering under terrible working conditions, with contracts being blatantly violated.

The bank, which presents itself as a progressive financial institution, is allegedly engaging in unfair labor practices that leave its workers struggling to survive.

According to the information shared with Nyakundi, employees at Loop NCBA are supposed to receive a basic salary of Ksh 10,000 plus commissions. However, the commissions are never paid, and even the basic salary arrives late on the 15th of the following month.

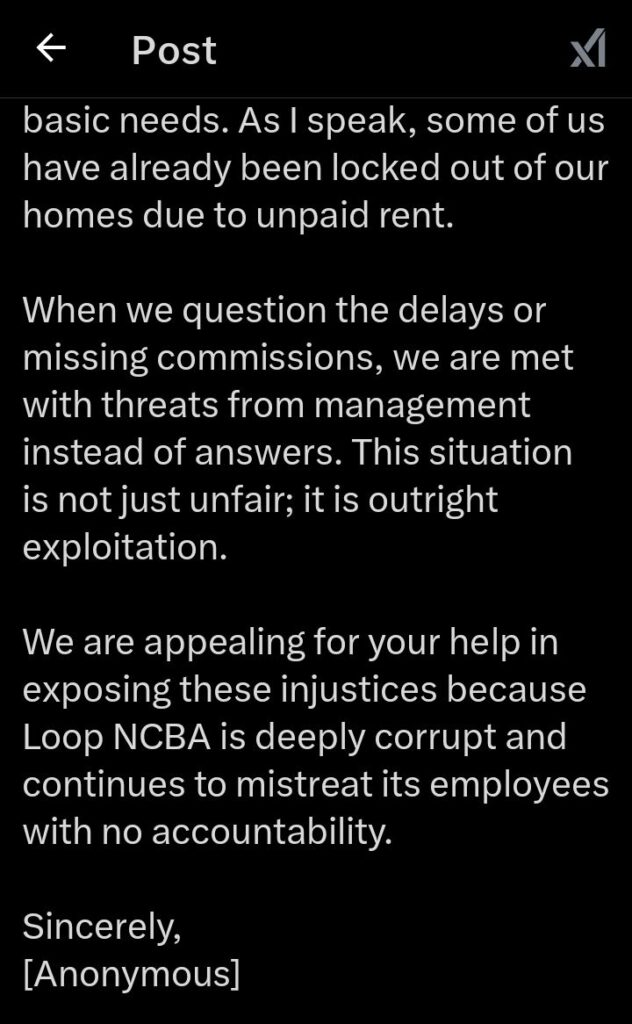

This delay causes severe financial strain, with some employees facing eviction due to unpaid rent. Instead of addressing these concerns, the management reportedly resorts to threats whenever workers ask about their rightful pay.

Such treatment raises serious questions about NCBA Bank’s ethics. This is an institution that enjoys massive profits from its operations, yet it refuses to pay its employees what they are owed. If a company cannot honor simple contractual agreements, what does that say about its credibility?

NCBA, which is partly owned by the Kenyatta family, has often been associated with questionable dealings, and this latest revelation only adds to the growing list of concerns.

The mistreatment of employees at Loop NCBA exposes a deeper issue within Kenya’s banking sector, where major financial institutions exploit young workers while pretending to champion innovation and growth.

Many young people join these institutions with the hope of building careers, only to be met with poor wages, delayed payments, and hostile working conditions. The fact that NCBA Bank, a major player in the industry, is engaging in such practices is unacceptable.

This also raises questions about regulatory oversight. Where is the Central Bank of Kenya in all this? Why are banks allowed to get away with treating employees unfairly? The lack of enforcement only emboldens institutions like NCBA to continue exploiting workers without consequences.

The public must also take note of how NCBA treats its employees because it reflects on its general business practices. If the bank can comfortably deny its workers their rightful pay, what does that say about how it treats its customers? Can account holders trust such an institution with their money?Loop NCBA’s reputation is now on the spotlight, and Cyprian Nyakundi’s exposé has given employees a platform to speak out.

However, the fight cannot stop here. There must be accountability, and NCBA must be pressured into treating its employees with the dignity and fairness they deserve. If the bank continues with this exploitation, then Kenyans should reconsider their relationship with it. Institutions that thrive on oppression must be exposed and held to account.