Cyprian Is Nyakundi has exposed yet another financial scandal involving Joel Gachari. In a post on his X page, he revealed that Gachari, the incompetent chairman of Mwalimu National Sacco, oversaw the disastrous acquisition of Spire Bank, leading to massive losses for teachers.

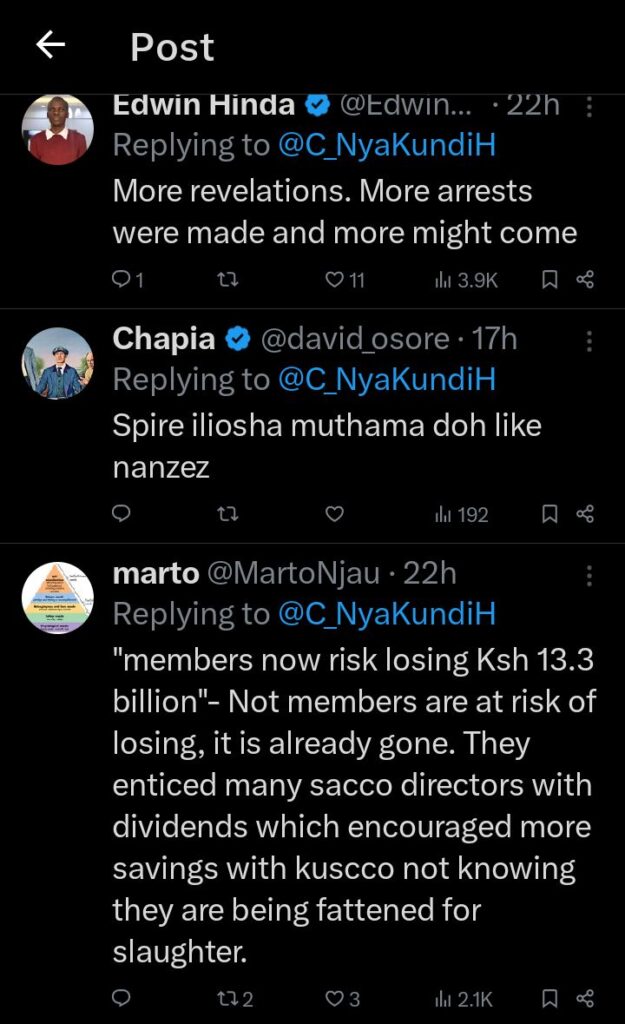

Now, it has emerged that Gachari was also on the board of KUSCCO, where members now risk losing KSh 13.3 billion. His track record speaks for itself he has a clear talent for sinking investments.

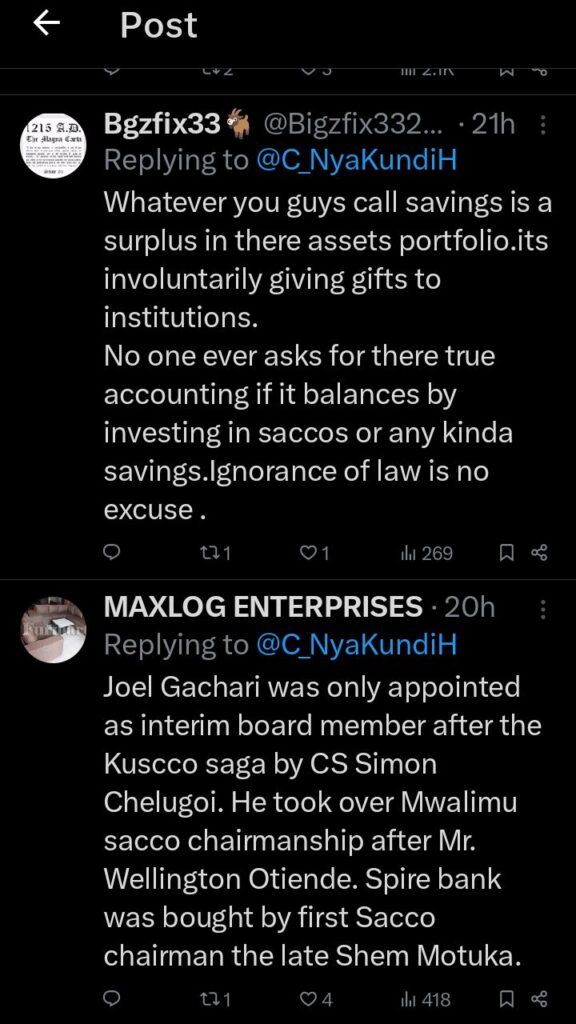

Mwalimu National Sacco, which serves Kenyan teachers, made a terrible mistake by acquiring Spire Bank in 2014. The bank was already struggling, recording huge losses and carrying bad loans.

Instead of turning it around, the acquisition only made things worse. Shortly after, the previous owner pulled out KSh 1.7 billion, leaving the bank in worse shape. Over time, Spire Bank’s financial situation did not improve, and eventually, teachers suffered the consequences.

Gachari, who was involved in this poor decision, did not face any repercussions.

Meanwhile, at KUSCCO, Gachari was part of another financial disaster. An audit exposed how KUSCCO’s financial records were manipulated to hide a deep crisis.

The report showed that the organization was insolvent, with liabilities far outweighing its assets. Even more shocking, the audit found that some financial statements were signed off by a dead auditor, exposing possible fraud.

With KUSCCO’s losses now standing at KSh 13.3 billion, hundreds of Saccos that rely on it are at risk of collapse. This is not just mismanagement it is a pattern of reckless leadership.

Gachari has been involved in two major financial failures, yet no action has been taken against him. The government has now been forced to step in, with authorities investigating the losses at KUSCCO. But for the teachers who lost millions in Spire Bank and the Sacco members now facing uncertainty, it is too little too late.

The damage has already been done.The exposure of these scandals raises serious questions about how people like Gachari continue to be given leadership roles despite a history of failure.

If accountability is not enforced, then more hardworking Kenyans will continue to lose their money due to the greed and incompetence of individuals who should never be trusted with public funds.