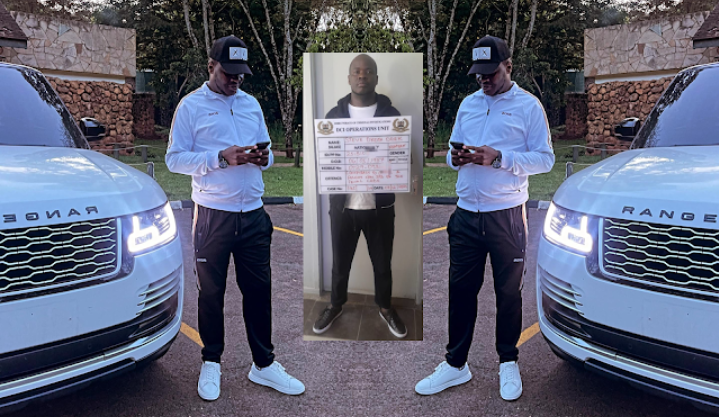

Steve Odek, also known by the alias David Bett, has re-emerged in the spotlight following his arraignment at the Milimani Law Courts on charges of conspiring to steal $265,200 (approximately Ksh 39.6 million).

The flamboyant businessman has long been associated with numerous high-profile fraudulent schemes that have made him a recurring figure in Kenya’s corridors of justice.

Odek’s latest charges are far from an isolated incident.

His past is riddled with accusations of involvement in fake currency and gold syndicates, which have victimized both local and international investors.

A 2019 case saw him arrested after a raid at his Plan 254 Club in Kilimani, Nairobi, where detectives discovered $1 million in counterfeit U.S. currency and 147 fake gold bars.

Odek reportedly attempted to mask his identity during that arrest by providing false names, an indication of the lengths he is willing to go to evade justice.

Further tarnishing his reputation is his alleged involvement in a 2013 kidnapping case.

Alongside five others, Odek was implicated in the abduction of two children of Indian origin.

The group reportedly demanded Ksh 86 million in ransom from the victims’ family, which operates a chain of hotels in East Africa.

Although he and his accomplices were arrested and arraigned, this incident highlighted his alleged propensity for orchestrating elaborate criminal schemes.

Beyond his criminal activities, Odek is notorious for his ostentatious lifestyle, funded through questionable means.

He once hosted a Ksh 2.5 million baby shower, attended by over 200 guests, including prominent figures from the entertainment and business sectors.

This extravagant event, combined with his habit of frequenting high-end establishments, underscores the disparity between his public persona and the murky dealings that allegedly sustain it.

Odek’s operations fit into a broader pattern of fraudulent activities in Kenya involving fake gold and currency scams, which have often embarrassed the nation on the international stage.

Such scams have defrauded high-profile victims, including foreign investors like Dubai’s ruler, Sheikh Mohammed Al Maktoum, who lost Ksh 400 million in a similar scheme.

The prevalence of these cases reflects poorly on Kenya’s regulatory and enforcement mechanisms, which continue to struggle against well-connected criminal networks.

The arrest and charging of Steve Odek are critical steps toward dismantling such networks.

However, his history of avoiding severe legal consequences raises questions about the efficacy of the justice system in dealing with repeat offenders like him.

This case is a glaring reminder of the need for heightened vigilance and accountability to address the rot of financial fraud in the country.