KCB Bank, a prominent financial institution in Kenya, is currently facing serious allegations involving EnglishPoint Marina, a luxury property in Mombasa.

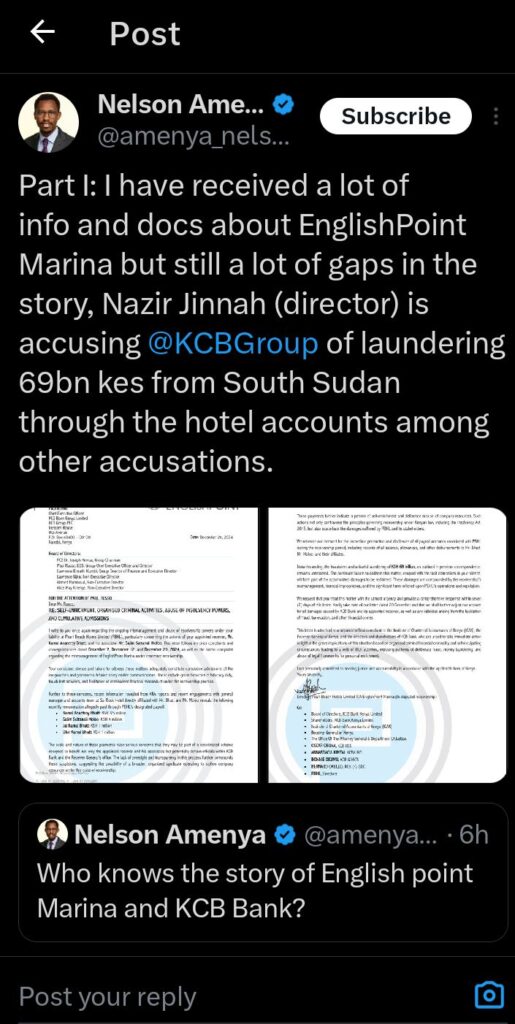

Nelson Amenya has revealed that Nazir Jinnah, a director of EnglishPoint Marina, accuses KCB of laundering 69 billion Kenyan shillings from South Sudan through the hotel’s accounts.

The financial relationship between KCB Bank and EnglishPoint Marina has been troubled.

KCB extended loans totaling 5.2 billion Kenyan shillings to Pearl Beach Hotels Ltd., the company behind EnglishPoint Marina, for its development.

Despite the project’s completion in 2017, Pearl Beach Hotels struggled to meet its repayment obligations.

This led KCB to take over the property and place it under statutory management to recover the outstanding debt.

Nelson Amenya has highlighted these developments, bringing attention to the ongoing financial disputes.

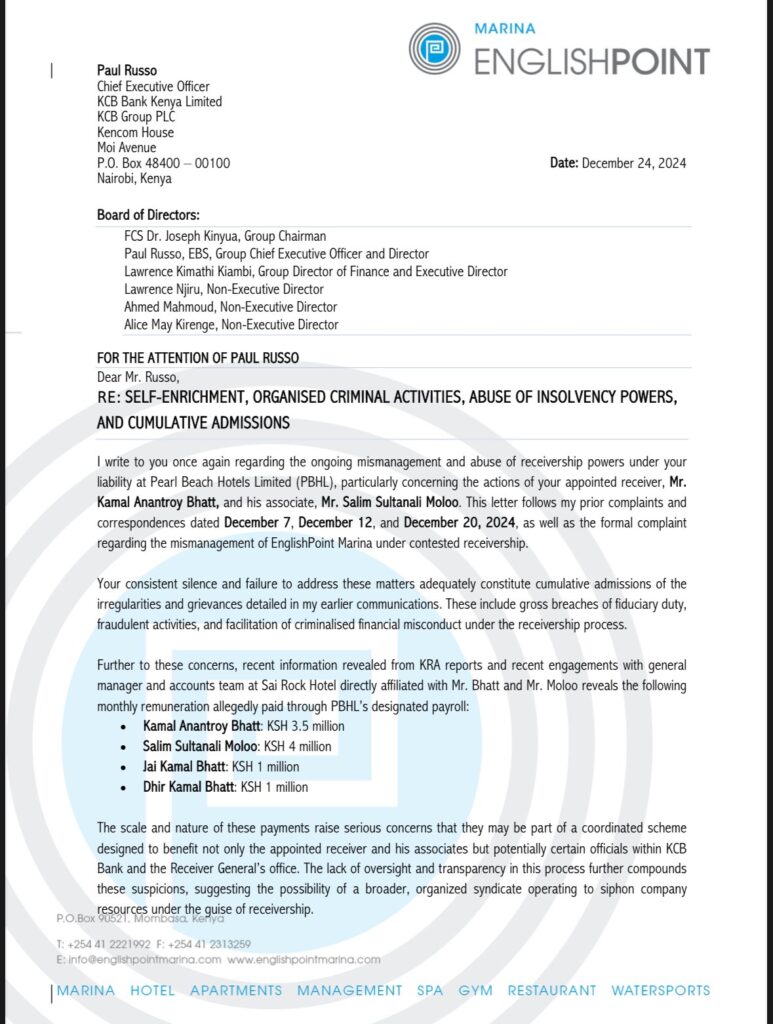

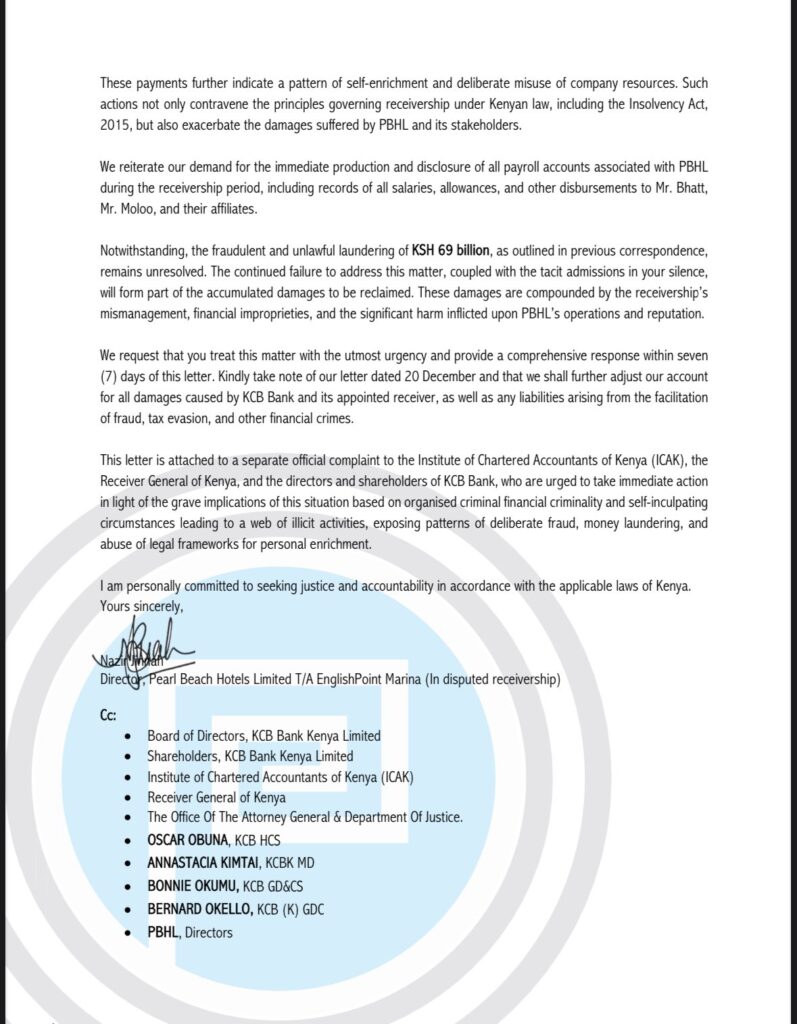

In response to the bank’s actions, the directors of EnglishPoint Marina accused KCB of overcharging them by more than 893 million Kenyan shillings on the loans.

They also alleged that KCB’s appointed receiver-manager was attempting to access funds held in other accounts, raising concerns about the bank’s conduct during the receivership process.

These issues, brought to light by Nelson Amenya, have intensified the scrutiny on KCB’s practices.

The recent allegations of money laundering add another layer of complexity to the ongoing disputes between KCB and EnglishPoint Marina.

The claim that KCB laundered 69 billion Kenyan shillings from South Sudan through the hotel’s accounts is serious and warrants thorough investigation by relevant authorities.

This is not the first time KCB has faced controversies.

In the past, the bank has been involved in various scandals, including issues related to non-performing loans and the handling of distressed properties.

For instance, KCB has been compelled to place companies under receivership to deal with mounting bad loans, with the ratio of gross non-performing loans to gross loans standing at 14.1 percent in April 2022.

The allegations brought forward by Nelson Amenya, highlighting Nazir Jinnah’s accusations against KCB, shed light on potential misconduct within the bank’s operations.

It is imperative for investigative bodies to look into these claims to ensure transparency and accountability in the banking sector.

Stakeholders and the public await further developments.

The outcome of these investigations will not only impact the parties directly involved but also influence the broader perception of the integrity of financial institutions in Kenya.