Cyprian Nyakundi has exposed yet another scandal involving Equity Bank, revealing how customers are being targeted with suspicious messages, fake calls, and even app lockouts. A concerned Equity Bank customer reached out to Nyakundi on X, detailing a disturbing pattern of fraudulent activities seemingly linked to the bank itself.

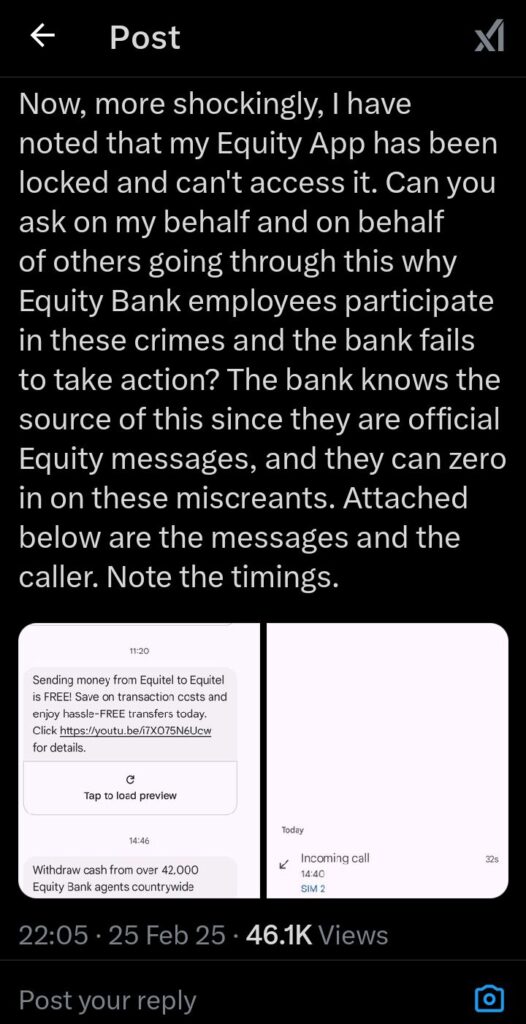

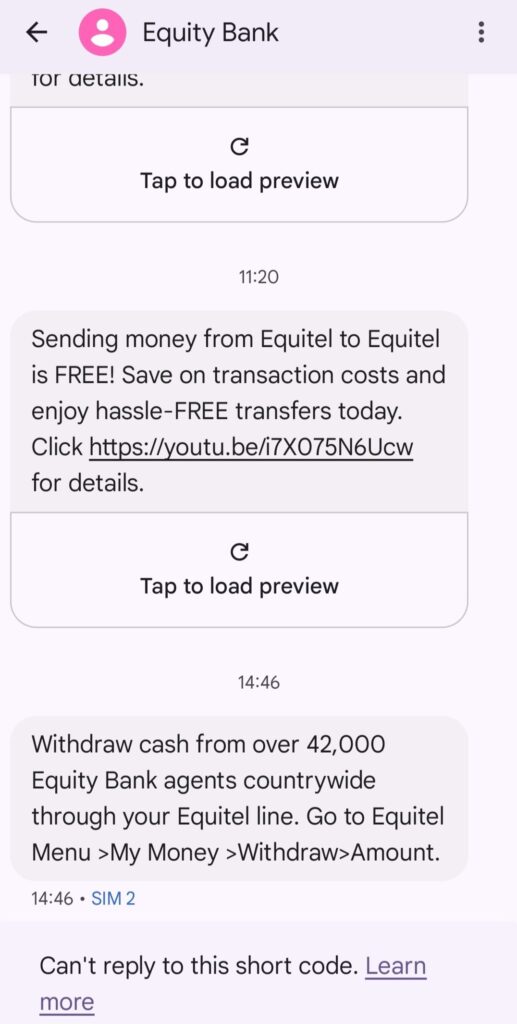

The individual had been receiving daily messages from Equity Bank asking them to check their account. However, things took a more alarming turn when a call came in from a strange number claiming to be from Equity Bank.

The caller insisted that the customer had not topped up their Equity airtime and warned that their line risked being deactivated. When confronted, the caller quickly backed off, confirming suspicions that this was part of a scam.

What is even more shocking is that shortly after the customer dismissed the call as a fraud, they discovered their Equity Bank app had been locked, making it impossible to access their account.

This raises serious questions about whether Equity Bank employees are involved in the fraud, given that the suspicious messages were official Equity notifications. The customer, through Nyakundi, is now demanding answers on why the bank has failed to crack down on these criminals despite having the capacity to trace them.

The bank knows where the messages are coming from, yet it has done nothing to stop them.Equity Bank has a long history of allegations involving fraud, customer exploitation, and questionable security practices.

This latest revelation adds to the growing concerns that the bank is either complicit in these scams or is too negligent to protect its customers.

If official Equity messages are being used in fraud schemes, then it means that either insiders are leaking customer data or the bank’s system has serious security loopholes.

Many Kenyans have reported cases of unauthorized transactions, mysterious deductions, and account lockouts, yet Equity has always remained silent or issued generic responses that do not address the root cause.

The fact that a customer’s Equity app was locked right after ignoring the fraudulent call is a clear sign that this is not just random fraudsters operating outside the bank. This points to an organized scheme where Equity employees could be collaborating with criminals to manipulate customer accounts, send fake warnings, and possibly even siphon money from unsuspecting victims.

It is no longer enough for Equity Bank to issue press statements denying involvement in such schemes. The bank needs to be held accountable and explain why customers are repeatedly falling victim to these scams.

Nyakundi’s exposé once again proves that Equity Bank is not as clean as it claims to be. If a major financial institution cannot protect its customers from fraudsters using its own messaging system, then it is either incompetent or corrupt.

The authorities should step in and investigate how deep this racket goes because many Kenyans could be losing their money without knowing who to blame. Equity Bank must answer for these scandals before more people fall victim to what now looks like a well-orchestrated fraud operation.